Key Considerations:

- Volatility: High volatility is crucial for this strategy to be profitable.

- News Impact: Carefully analyze the potential market impact of upcoming news events.

- Implement strict stop-loss orders to limit potential losses.

Identifying and Capitalizing on Volatile Events

Choose an event known for significant market movement.

- Examples:

- Economic Releases: High-impact events like Non-Farm Payrolls, Consumer Price Index (CPI), and interest rate decisions often trigger substantial price swings.

- Market Openings: The opening bell of major stock exchanges can see rapid price movements.

- Earnings Reports: Reports from major companies, particularly those with high market capitalization, can generate significant volatility.

Researching Event Impact

Analyze historical data to understand the typical price movement during past instances of your chosen event.

- Example: If trading the CPI release, review past CPI releases to observe the average price movement of your chosen instrument (e.g., Nasdaq futures).

- Utilize Resources: Tools like Forex Factory can help you identify upcoming economic releases and their potential impact.

Calculating Target Move

Determine the price movement required to reach your evaluation's profit target.

- Formula:

- (Profit Target) / (Number of Contracts) / (Tick Size) = Ticks Required

- Example:

- For a $50,000 account with a $3,000 profit target, trading 10 contracts of Nasdaq futures ($5 per tick):

- $3,000 / 10 contracts / $5 per tick = 60 ticks

- Account for potential slippage and commissions by adding a buffer (e.g., 63-64 ticks).

Entering and Managing the Trade

- Entry: Place a market order immediately before the event (e.g., 15 minutes before the CPI release).

- Risk Management:

- Stop-Loss Calculation:

- (Account Balance) / (Number of Contracts) / (Tick Size) = Stop-Loss Ticks

- Example: $50,000 / 10 contracts / $5 per tick = 100 ticks

- Set a Stop-Loss Order: Implement the calculated stop-loss order to limit potential losses if the trade moves against you.

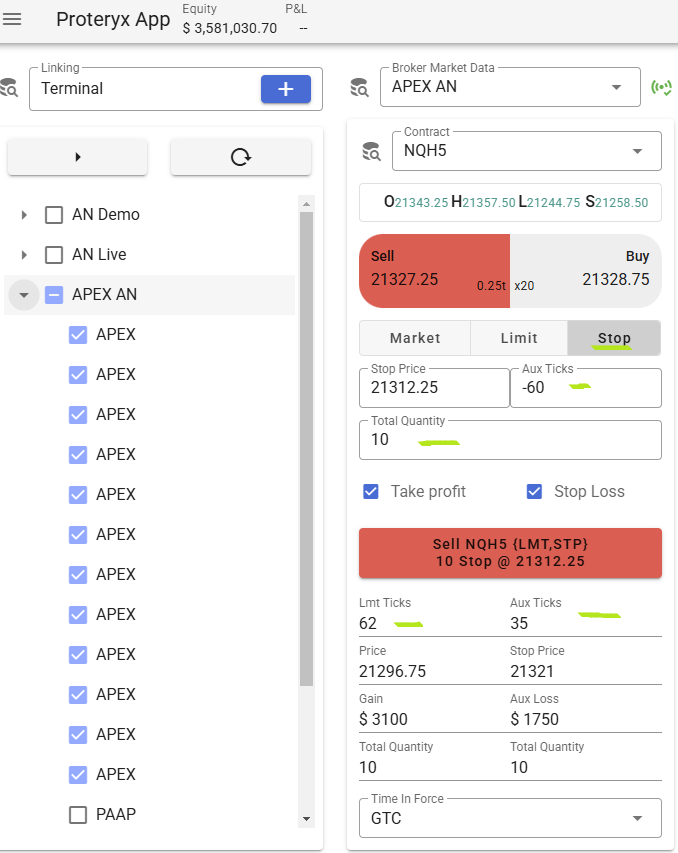

In the following image you will see how to place exactly this order:

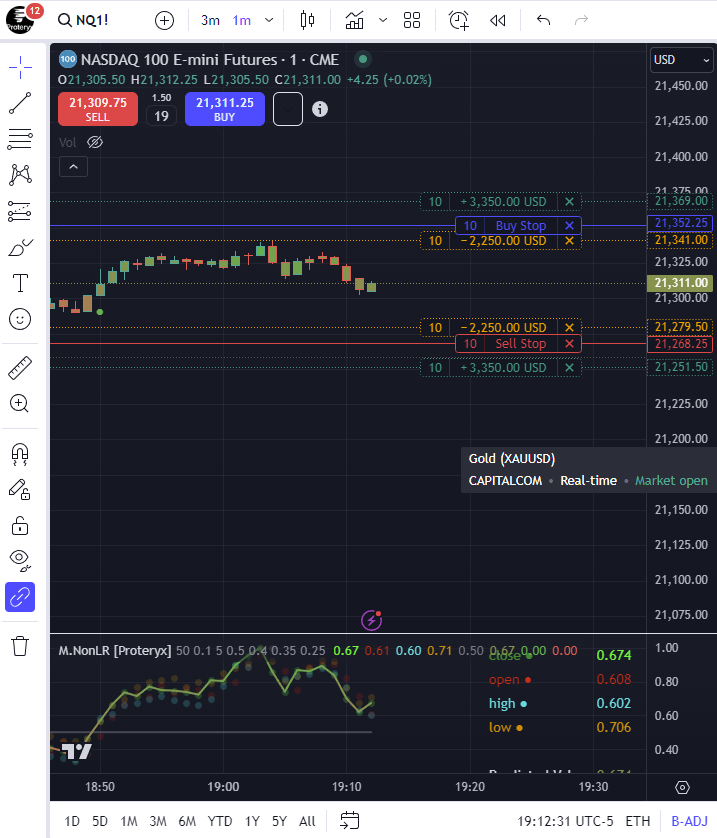

Once you Hit send you will see the order working as a stop order with it's brackets:

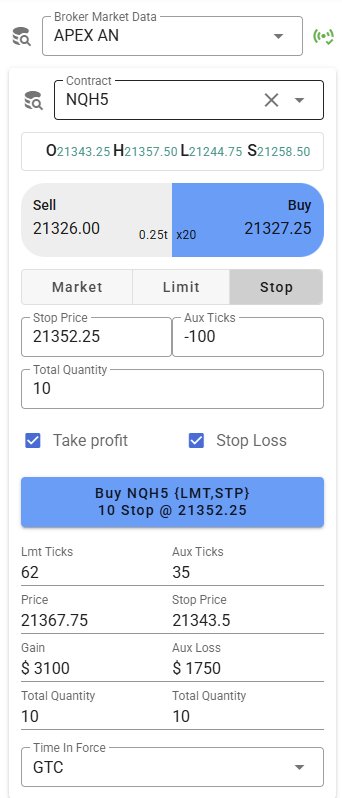

You can do the same for the buy order, just change Sell to Buy:

We just need the market to rocket or to plummet for one of those 2 orders to be filled.

Join our community Connect with fellow traders on Discord and social media for updates, tips, and insights.

To help you get started quickly and answer any questions you may have, we'd love for you to join our next onboarding call.

This brief 5-10 minute session is your chance to connect with me directly and get personalized guidance on setting up your account.

Onboarding Call:

- Link: https://tidycal.com/proteryx/introductory-call

- Duration: 5-10 minutes

Can't make the call? No problem!

If you have a specific question that you can't wait for, you're also welcome to reach out to us via email at [email protected]. We pride ourselves on our responsiveness and aim to reply to all inquiries within an hour during business hours.

We're here to help you succeed, so don't hesitate to reach out!

Best regards,

The Proteryx Team